Today fintech in Saudi Arabia has turned phones into banks and money is moving faster than a racing car.

And Saudi Arabia is building a place where technology and money join hands to create something amazing and fast-paced.

In Saudi Arabia, fintech is like a buzzing beehive of innovation.

So, after previously discussing the fintech industry in Egypt, now it is time to explore the Saudi fintech industry, as well.

We will be shedding light on:

How big is the fintech industry in Saudi?

How many fintech companies are there in Saudi Arabia?

What is the KSA national fintech strategy?

What is the future of fintech in Saudi Arabia?

—-

An Overview of Saudi Fintech Industry

The Saudi fintech scene is a very dynamic environment where fintech startups, innovation hubs, and regulatory authorities collaborate to redefine the future of monetary transactions.

This transformative scene is reshaping how Saudis engage with their finances, presenting a future where financial services are not only easily accessible but also secure and remarkably efficient.

From the backing of the government to the ingenuity of startups, Saudi Arabia’s fintech ecosystem is a treasure trove of potential, extending a warm invitation to individuals as well as businesses.

How Big is The Saudi Fintech Market?

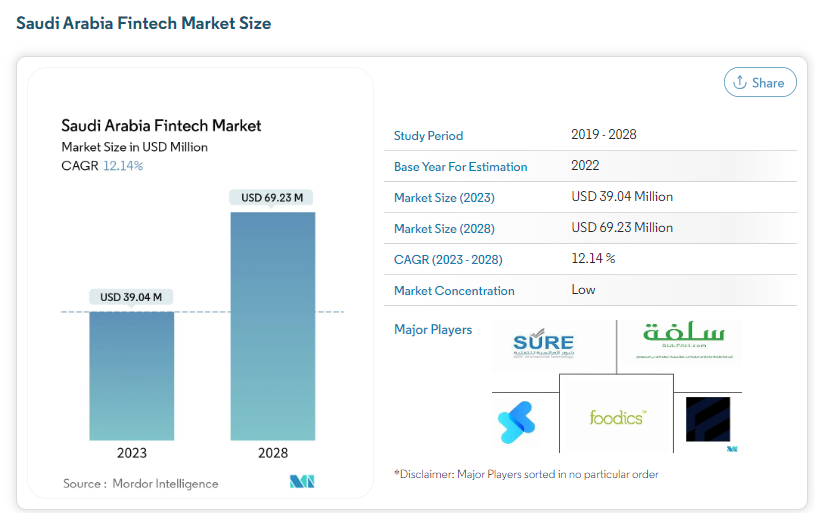

The current Saudi fintech market size is expected to grow from USD 39.04 million in 2023 to USD 69.23 million by 2028 (Source: mordorintelligence.com).

How Many Fintech Companies Are There in Saudi Arabia?

The Fintech initiative announced in November 2022 that the number of fintech companies in Saudi Arabia continued to grow reaching 147 companies in 2022 — a growth of 14.7 times, compared to 2018, when there were only 10 companies (Source: zawya.com)

Here’s a list of the main categories and some of the standout players within them:

1. Money Transfer & E-Wallets in Saudi Arabia

2. BNPL Companies in Saudi Arabia

2. Financial Infrastructure in Saudi Arabia

3. Investment & Wealth Management

4. E-Payment & SME Fintech Solutions in Saudi Arabia

What Is the KSA National Fintech Strategy?

Developed by the Saudi Arabian Monetary Authority (SAMA), KSA National Fintech Strategy aims to create a dynamic fintech ecosystem that supports startups, encourages technological advancements, and enhances financial services across the nation.

The strategy is designed to address multiple dimensions of fintech development, fostering collaboration between the public and private sectors, promoting regulatory clarity, and nurturing a culture of innovation.

The key components of the strategy are:

- Financial Inclusion

- International Collaboration

- Cybersecurity and Data Privacy

- Promotion of Digital Payments

- Access to Funding

As Saudi Arabia advances towards its Vision 2030 goals of economic diversification and technological advancement, fintech emerges as a linchpin in realizing these ambitions.

By leveraging fintech’s potential, the strategy envisions a future where Saudi Arabia becomes a regional fintech hub, propelling the nation towards digital transformation and economic diversification.

What Is The Future of Fintech in Saudi Arabia?

The future of fintech in Saudi Arabia is very promising with innovation, collaboration, and limitless possibilities for businesses in various areas of business.

As the fintech landscape continues to evolve, Saudi Arabia stands at the forefront of this transformation, leveraging fintech to shape a more accessible, efficient, and inclusive financial ecosystem.

From cutting-edge digital banking experiences to novel payment methods, the Saudi fintech landscape is brimming with potential breakthroughs.

The future of fintech in Saudi Arabia is not just about innovation—it’s about rewriting the narrative of finance itself.

In Conclusion

The journey through Saudi Arabia’s fintech landscape is a thrilling expedition into a world of possibilities.

As technology and finance come together, the nation stands to redefine financial services, foster innovation, and enhance inclusivity.

The evolution of fintech isn’t just a transformation of industries; it’s a transformation of lives, opportunities, and the very way we envision financial transactions.

And the businesses that seize the fintech wave will lead the charge toward a prosperous and tech-driven future.

So, whether you’re an business owner, an investor, or just someone curious about the winds of change, keep your eyes on the fintech scene in Saudi Arabia – because the future holds incredible opportunities.

Searching for a web design and development company in Saudi Arabia? Talk to our experts today.